As Labour touts success with £63 billion in private sector investment, questions remain over the long-term impact of new regulations and the upcoming budget

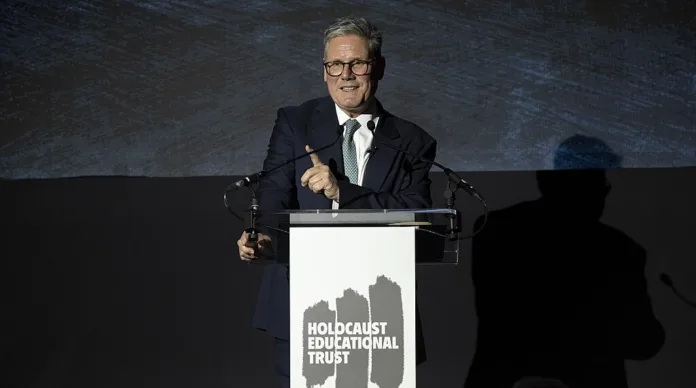

Keir Starmer’s International Investment Summit on Monday was marked by a palpable sense of optimism, particularly the recurring theme of “stability” after years of political upheaval. With the UK having endured four prime ministers and six chancellors in the past eight years, international investors are seeking assurance. Starmer promised that a Labour majority would create a more stable environment conducive to investment.

Anders Opedal, CEO of Norwegian energy giant Equinor, noted the government’s efforts to improve collaboration with the private sector, stating, “Now it is about execution and getting the execution right.” This sentiment was echoed by Amanda Blanc, head of the pension and insurance firm Aviva, who described the atmosphere at the summit as “very positive.”

However, the discussions were not without controversy. Starmer made it clear that while regulation is necessary, he aimed to eliminate excessive red tape that hampers infrastructure development. He referenced the cumbersome requirement for energy companies to fill out 4,000 documents before commencing construction. Yet, the government recently introduced significant employment regulations, including higher minimum wages and increased workers’ rights. Business leaders, including billionaire John Caudwell, expressed concern over these additional burdens, which they fear could stifle growth.

Embed from Getty ImagesDespite these challenges, Starmer highlighted the benefits of secure and well-paying jobs, arguing that they boost disposable income and consumer spending. However, the impending Budget looms large over the summit, with Chancellor Rachel Reeves hinting at possible National Insurance contributions on employer pension contributions, a move that could impose a £10 billion to £20 billion burden on businesses.

THE GUARDIAN

In a bid to attract foreign investment, Prime Minister Keir Starmer and the Labour government hosted a lavish event for global business leaders at the historic Guildhall in London. The evening culminated in an exclusive reception at St. Paul’s Cathedral, featuring performances by Elton John and a gourmet dinner prepared by renowned three-star Michelin chef Clare Smyth. This charm offensive aimed to secure an impressive £63 billion in investment pledges, signalling the UK’s renewed commitment to being “open for business” following years of political instability under the previous Conservative administration.

The summit attracted CEOs from major firms such as Goldman Sachs, BlackRock, and HSBC. Starmer and Business Secretary Jonathan Reynolds worked to address potential fallout from a recent cabinet dispute involving Transport Secretary Louise Haigh, who had reportedly jeopardised a £1 billion investment announcement from DP World, a Dubai-based company. Despite these tensions, the government sought to present an image of stability and growth, critical components of its economic strategy.

During the event, Starmer emphasised the importance of private investment, declaring to the executives, “You are pivotal to this great cause of our times.” The atmosphere was charged with excitement, as business leaders engaged in informal discussions about Labour’s new industrial strategy.

However, concerns arose as Chancellor Rachel Reeves hinted at possible increases in employer national insurance contributions, prompting criticism regarding potential breaches of the Labour manifesto. This juxtaposition of opulent hospitality and pressing economic challenges highlights Labour’s struggle to balance attracting investment while remaining true to its promises, marking a significant moment in the party’s efforts to strengthen ties with the business community.

BBC

At the International Investment Summit in London, Prime Minister Keir Starmer emphasised “stability” as a key theme, contrasting the previous tumultuous years of multiple prime ministers and chancellors. Starmer aimed to attract foreign investment, with notable backing from figures like Anders Opedal, CEO of Equinor, who praised the government’s collaborative strategy with the private sector. Domestic business leaders, including Amanda Blanc from Aviva, echoed positive sentiments about the event’s atmosphere.

However, regulation emerged as a contentious topic. Starmer expressed a desire to eliminate burdensome regulations that hinder infrastructure projects, such as requiring energy companies to complete thousands of documents. Yet, the government had recently introduced significant increases in employment regulation, raising concerns among business leaders. Former Conservative donor John Caudwell acknowledged that while additional worker rights could burden businesses, investors might accept these challenges if the broader economic growth goal is met.

The looming Budget, set for later this month, remained a critical concern. Chancellor Rachel Reeves hinted at the possibility of imposing National Insurance contributions on employer pension contributions, which could significantly impact businesses. She also suggested re-evaluating traditional national debt measurements to allow for greater infrastructure investment, although this could raise borrowing costs.

Labour officials claimed success by announcing £63 billion in private sector investment, surpassing the £39 billion raised at last year’s summit under Rishi Sunak. However, the actual impact of these investments remains uncertain, as many may have been planned regardless of the summit, and the upcoming Budget could heavily influence investor sentiment moving forward.